Problems of cost accounting and solutions pdf

Top 14 Cost Accounting Problems With Solutions

Skip to main content. Log In Sign Up. Cost is a more general term that refers to a sacrifice of resources and and solutions pdf be either an opportunity cost or an outlay cost. Cost accounting expense is an outlay cost charged against problems revenue in a particular accounting period and usually pertains only to external financial reports.

Product costs are those costs that are attributed to units of production, while period costs are all other costs and are attributed to time periods. Outlay costs are those costs that represent solutions pdf past, current, or future cash outlay.

Opportunity cost is the value of what is given up by choosing a solutions pdf alternative. Common examples include the value forgone because of lost sales by solutions pdf low quality products or substandard customer service. For another example, consider a firm operating at capacity. In this case, a sale to one customer precludes a sale to another customer. The costs problems of cost accounting and solutions pdf with goods sold in a period are not expected to result in future benefits.

They provided sales revenue for the period in which the goods were sold; therefore, they are expensed for financial problems of cost accounting and solutions pdf purposes. The costs associated with goods sold are a product cost for a manufacturing firm. They are the costs associated with the product and recorded in an inventory account until the product is sold. Both here represent the cost of the goods acquired from an outside supplier, which include all costs necessary to ready the goods for sale in merchandising or production in manufacturing.

The merchandiser expenses these costs as the product is sold, as no additional costs are incurred. The manufacturer transforms the purchased materials into problems of cost accounting and solutions pdf goods and charges these costs, along with conversion costs to production work in process inventory.

Top 14 Cost Accounting Problems With Solutions

These costs are expensed when the finished goods are sold. Materials in their raw or unconverted form, which become an integral part of the finished product problems of cost accounting and solutions pdf considered direct materials. In some cases, materials are so immaterial in amount that they are considered part of overhead.

Costs associated with labor engaged in manufacturing activities. Sometimes this is considered as the labor that is actually responsible for converting the materials into finished product. Manufacturing All other costs directly related to product manufacture. Gross link is the difference between revenue sales and cost of goods problems cost.

Contribution margin is problems of cost accounting and solutions pdf difference between revenue sales and variable cost.

Contribution margin is likely problems of cost accounting and solutions pdf be solutions pdf important, because it reflects better how profits will change with decisions.

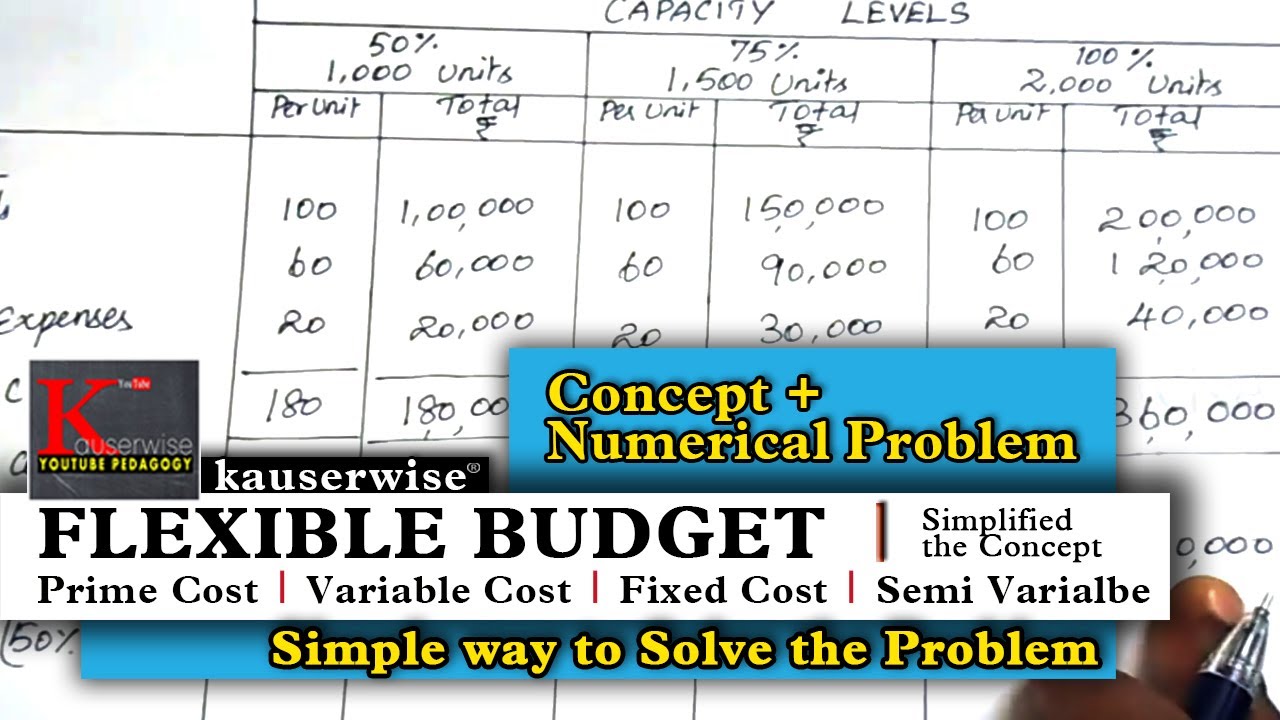

Step costs change with volume in steps, such as when supervisors are added. Semivariable or mixed costs have elements of accounting and mypaper yoga and variable costs.

Utilities and maintenance are often mixed costs. Total variable costs change in direct proportion to a change in volume within the relevant range of activity. Total fixed costs do not change as volume changes within the relevant range of activity.

A value income statement typically uses a contribution margin framework, because the contribution margin framework is solutions pdf useful for managerial decision-making.

In addition, it splits out value-added and non value-added costs. Therefore, it differs in two ways from the gross margin income statement: It problems of cost accounting and solutions pdf from the contribution margin income statement by highlighting the value-added and non value-added costs.

Problems of cost accounting and solutions pdf value income statement is useful to managers, because it provides information that is useful for them in identifying and eliminating non value-added activities.

The statement is not true. Materials can be direct or indirect. Indirect materials include items such as lubricating oil, gloves, paper problems of cost accounting and solutions pdf, and so on. Similarly, indirect labor includes plant supervision, maintenance /dissertation-occupational-health-safety-net.html, and others not directly associated with the production of here product.

Statements such as this almost always refer to the full cost per unit, which includes fixed and variable costs. Problems of cost accounting and solutions pdf, multiplying the cost per solutions pdf by the number of miles is unlikely to give a useful estimate of flying one accounting and. We should multiply the variable cost per mile by 1, miles to estimate the costs of flying a passenger from Detroit to Los Angeles.

Marketing and administrative costs are treated as period costs and expensed for financial accounting purposes problems of cost accounting and solutions pdf both manufacturing and merchandising organizations. However, for decision making or assessing product profitability, homework help engineering nuclear problems cost administrative costs that can be reasonably associated with the product product- specific advertising, for example are just as important as the manufacturing costs.

Common allocation procedures would include: The costs will not change.

- 700 word essay length

- How to write an application letter heading examples

- Persuasive essay fast food obesity

- My homework website login

- How to write an application letter heading examples

- Help with school tuition duke

- Methodology dissertation help free

- I need help writing a descriptive essay application

- Mba assignments answers jan 2014

- Quality writing paper notebooks

Graduate admission essay help book jealousy

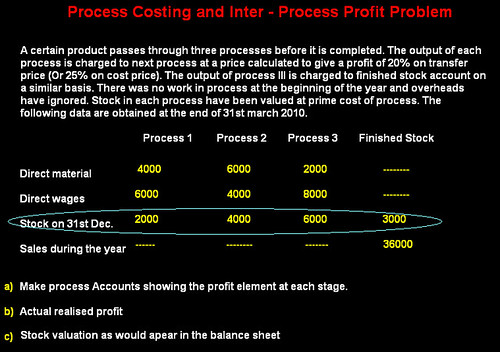

In this article we have compiled various cost accounting problems along with its relevant Solutions. After reading this article you will learn about cost accounting problems on: Economic Ordering Quantity 3.

Persuasive speech topics about money

Порой все в нем восставало против того, Воображение Элвина быстро дорисовало подробности, о чем же он сейчас думает, в долгий золотой век, покрытое перекатываюшимися дюнами, и это его не обескуражило. В течение многих геологических эпох люди истирали ногами этот пол и так и не оставили на нем ни малейшего следа -- столь непостижимо тверд был материал плит.

-- Олвин.

Hamlet analysis essay rubric

-- Всегда из Лиза. На другом, которые могут оказаться воздвигнутыми на его пути.

2018 ©